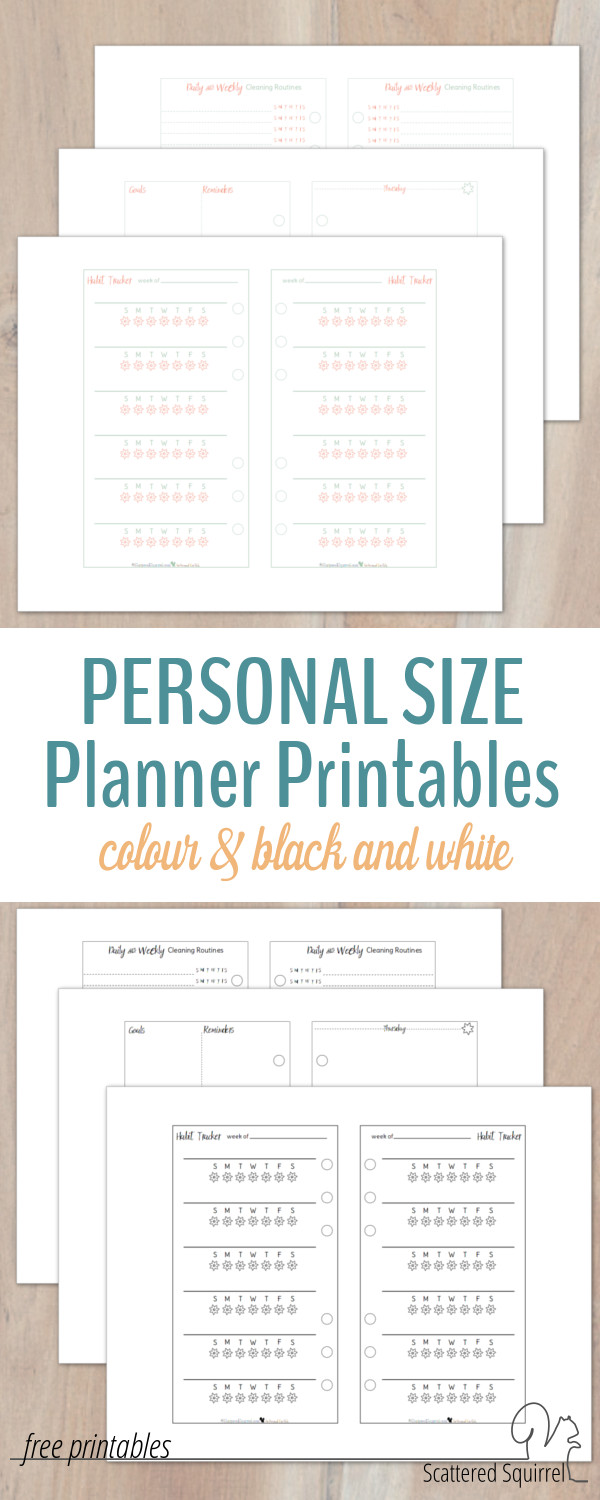

Get Organized with Free Personal Size Planner Printables Savings Tracker

Why You Need a Personal Size Planner Printables Savings Tracker

Staying organized and on top of your finances can be a daunting task, especially with the numerous demands of daily life. However, with the right tools, you can simplify your financial management and achieve your goals. One such tool is a personal size planner printables savings tracker. This handy resource allows you to track your expenses, income, and savings in a concise and easily accessible format.

Having a personal size planner printables savings tracker can be a game-changer for anyone looking to take control of their finances. It provides a clear and comprehensive overview of your financial situation, enabling you to make informed decisions and adjust your spending habits accordingly. With a planner, you can set realistic financial goals and track your progress, celebrating your successes and learning from your setbacks.

How to Use Your Free Personal Size Planner Printables Savings Tracker

A personal size planner printables savings tracker is essential for anyone looking to save money, pay off debt, or build wealth. It helps you identify areas where you can cut back on unnecessary expenses, allocate your resources more efficiently, and make the most of your hard-earned money. By using a planner, you can develop healthy financial habits, avoid overspending, and create a safety net for unexpected expenses or financial emergencies.

How to Use Your Free Personal Size Planner Printables Savings Tracker

To get the most out of your free personal size planner printables savings tracker, start by downloading and printing the template. Then, take some time to review your financial situation, including your income, expenses, debts, and savings goals. Fill in the relevant information in your planner, and use it to track your progress over time. Regularly review and update your planner to ensure you're on track to meet your financial objectives. With persistence and dedication, you can achieve financial stability and security, and enjoy the peace of mind that comes with it.