Create a Stress-Free Financial Life with a Household Budget Template Printable

Why You Need a Household Budget Template

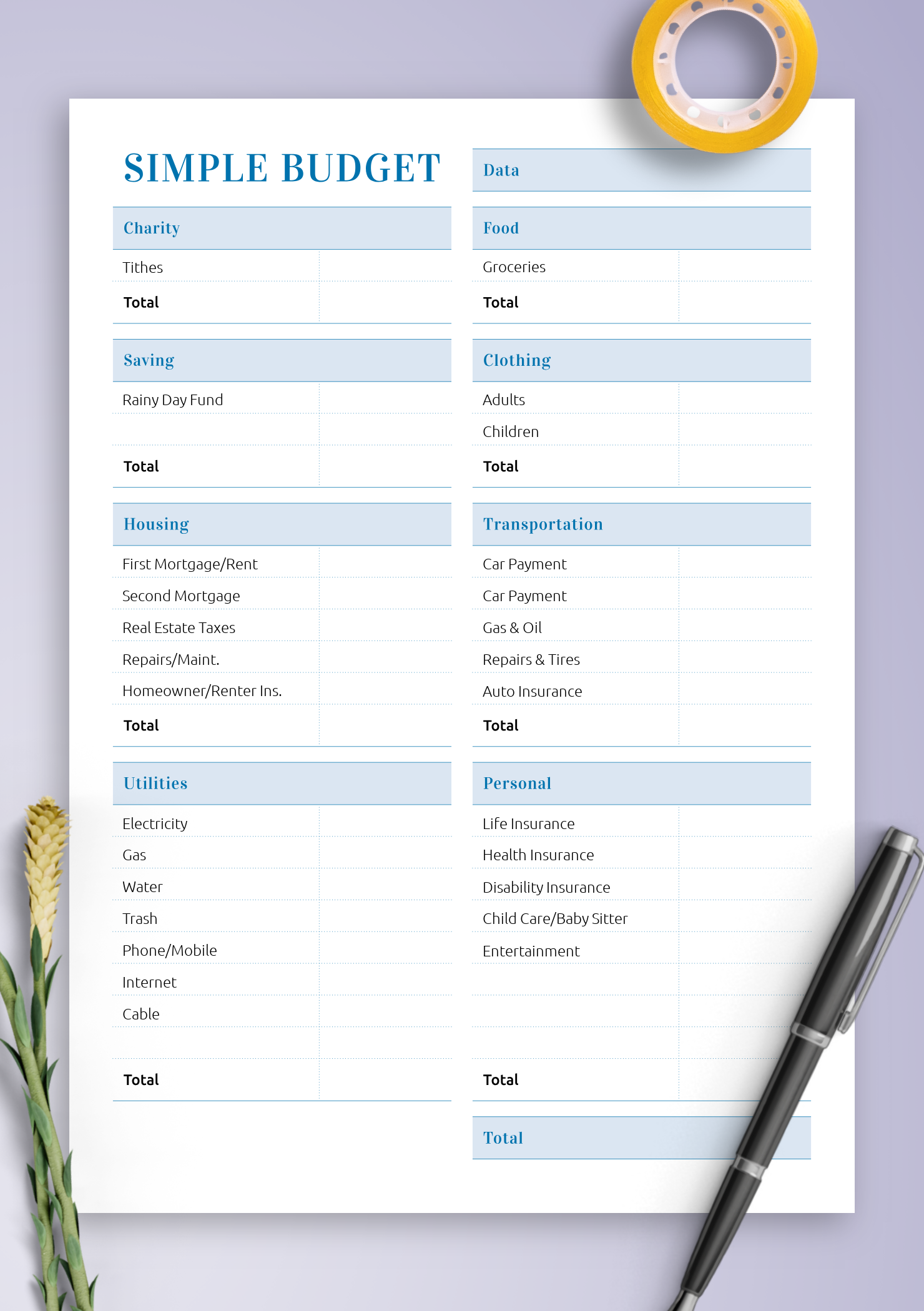

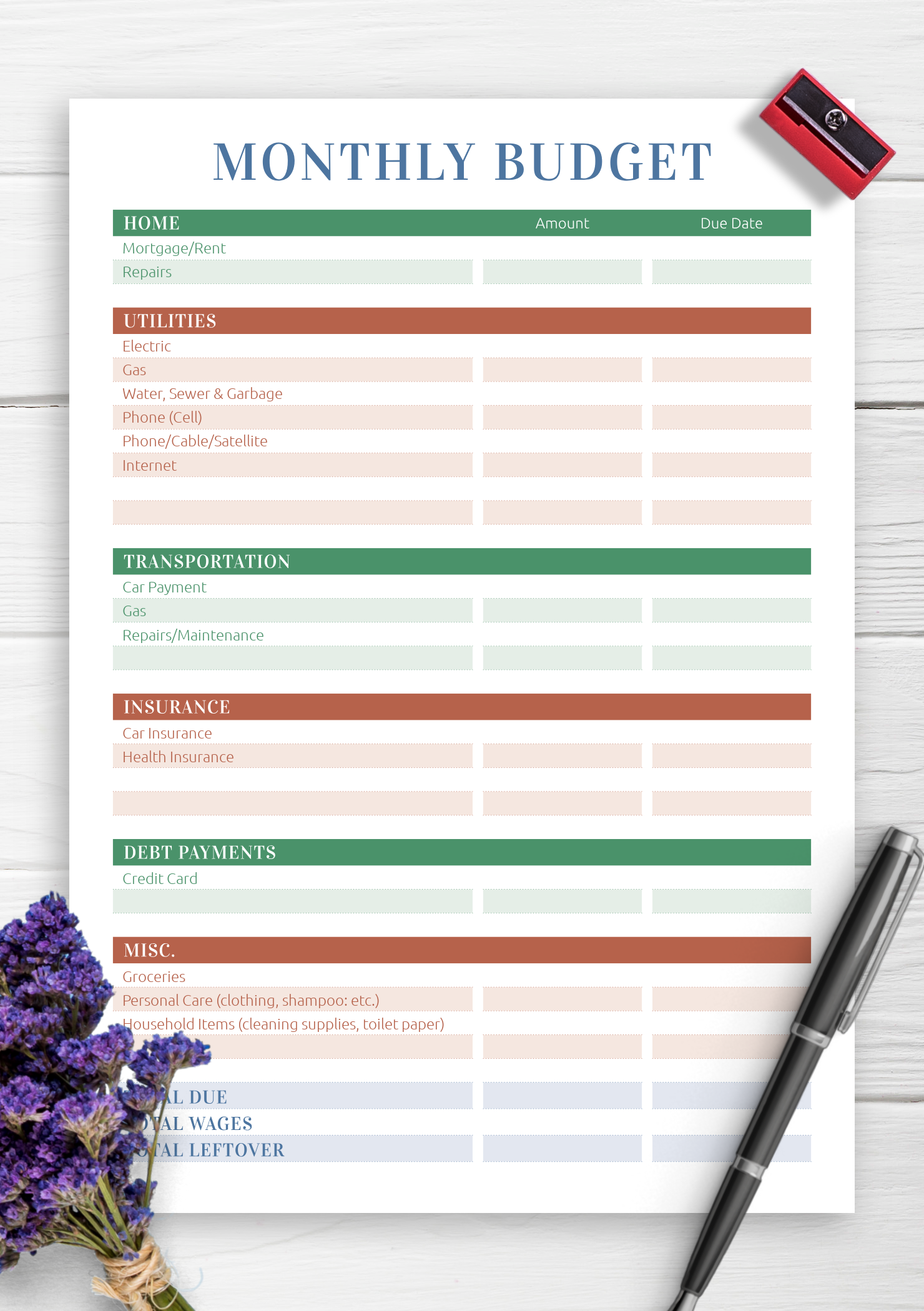

Managing your household finances can be a daunting task, but it doesn't have to be. With a household budget template printable, you can take control of your money and start building a more secure financial future. A budget template is a simple and effective way to track your income and expenses, making it easier to identify areas where you can cut back and save. By using a budget template, you can create a personalized plan that works for you and your family, helping you to achieve your financial goals.

Having a budget in place can help you to avoid debt, build savings, and make smart financial decisions. It can also help you to prioritize your spending, making sure that you're allocating your money to the things that matter most to you. With a household budget template printable, you can easily see where your money is going and make adjustments as needed. This can be especially helpful during times of financial uncertainty or when you're trying to make big purchases, such as a car or a home.

How to Use a Household Budget Template Printable

A household budget template printable is a valuable tool for anyone looking to get their finances in order. It provides a clear and concise way to track your income and expenses, making it easier to stay on top of your money. With a budget template, you can set financial goals and work towards achieving them. You can also use it to identify areas where you can cut back and save, helping you to build a more secure financial future. By using a household budget template printable, you can take control of your finances and start building a brighter financial future.

Using a household budget template printable is easy. Simply download and print the template, then fill in your income and expenses. You can customize the template to fit your specific needs, adding or removing categories as needed. Once you have your budget in place, you can use it to track your spending and make adjustments as needed. You can also use it to set financial goals and work towards achieving them. By following these simple steps, you can create a budget that works for you and start building a more secure financial future.