Creating a Personalized Budget Worksheet for Financial Success

Why You Need a Budget Worksheet

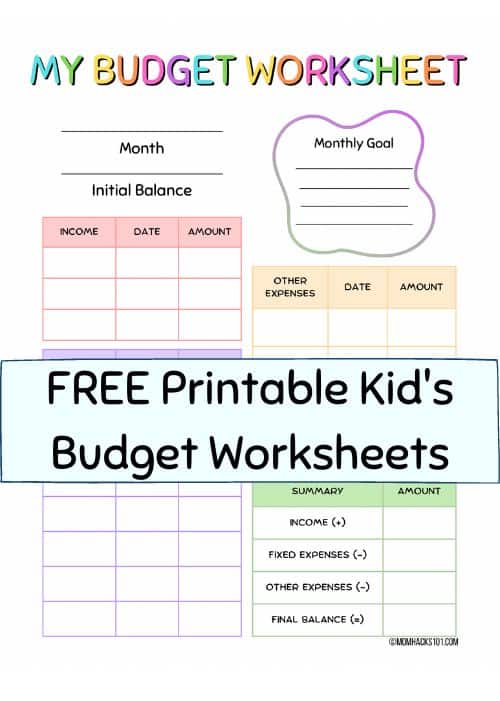

Making a budget worksheet is an essential step in taking control of your finances. It helps you track your income and expenses, identify areas where you can cut back, and make informed decisions about how to allocate your money. With a budget worksheet, you can set financial goals and work towards achieving them. Whether you're looking to save money, pay off debt, or build wealth, a budget worksheet is a valuable tool that can help you get there.

Having a budget worksheet can help you avoid financial stress and uncertainty. By keeping track of your income and expenses, you can ensure that you have enough money to cover your necessary expenses, such as rent, utilities, and food. You can also use your budget worksheet to identify areas where you can cut back on unnecessary expenses and allocate that money towards your financial goals.

Steps to Create a Budget Worksheet

A budget worksheet can help you develop healthy financial habits and avoid common financial pitfalls. By regularly reviewing your budget worksheet, you can identify trends and patterns in your spending and make adjustments as needed. You can also use your budget worksheet to plan for large purchases or expenses, such as a down payment on a house or a vacation.

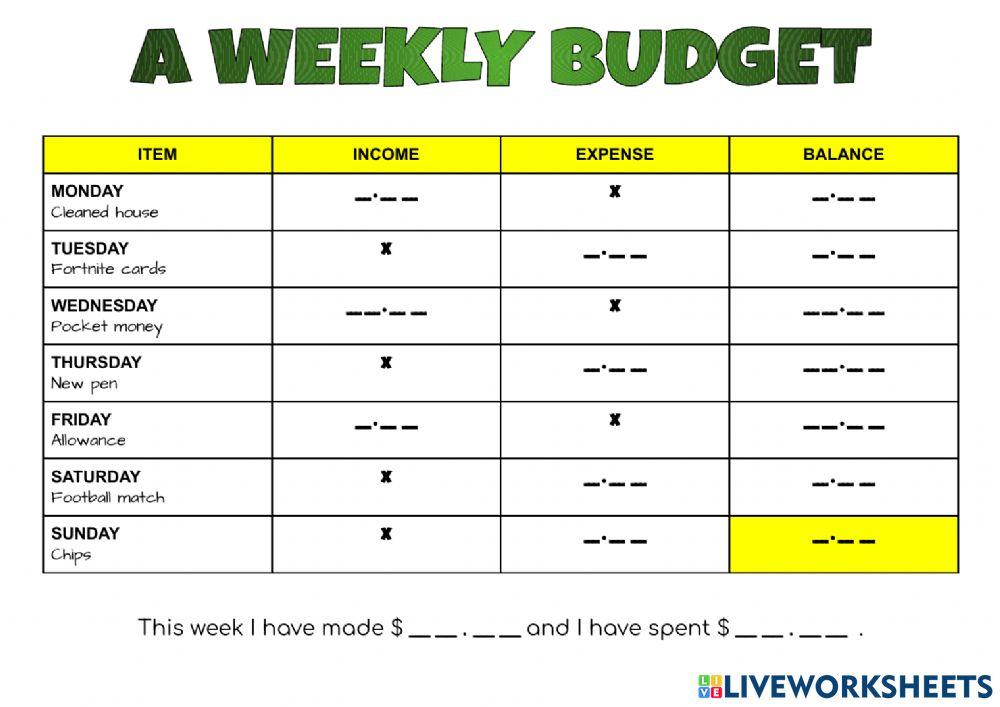

To create a budget worksheet, start by gathering all of your financial documents, including pay stubs, bills, and bank statements. Next, calculate your total monthly income and list all of your necessary expenses, such as rent, utilities, and food. Then, list your discretionary expenses, such as entertainment and hobbies. Finally, subtract your total expenses from your total income to determine how much money you have left over each month. You can use this amount to save, invest, or pay off debt.