Create a Stress-Free Financial Life with a Monthly Household Budget Worksheet Pdf

Why You Need a Monthly Household Budget Worksheet Pdf

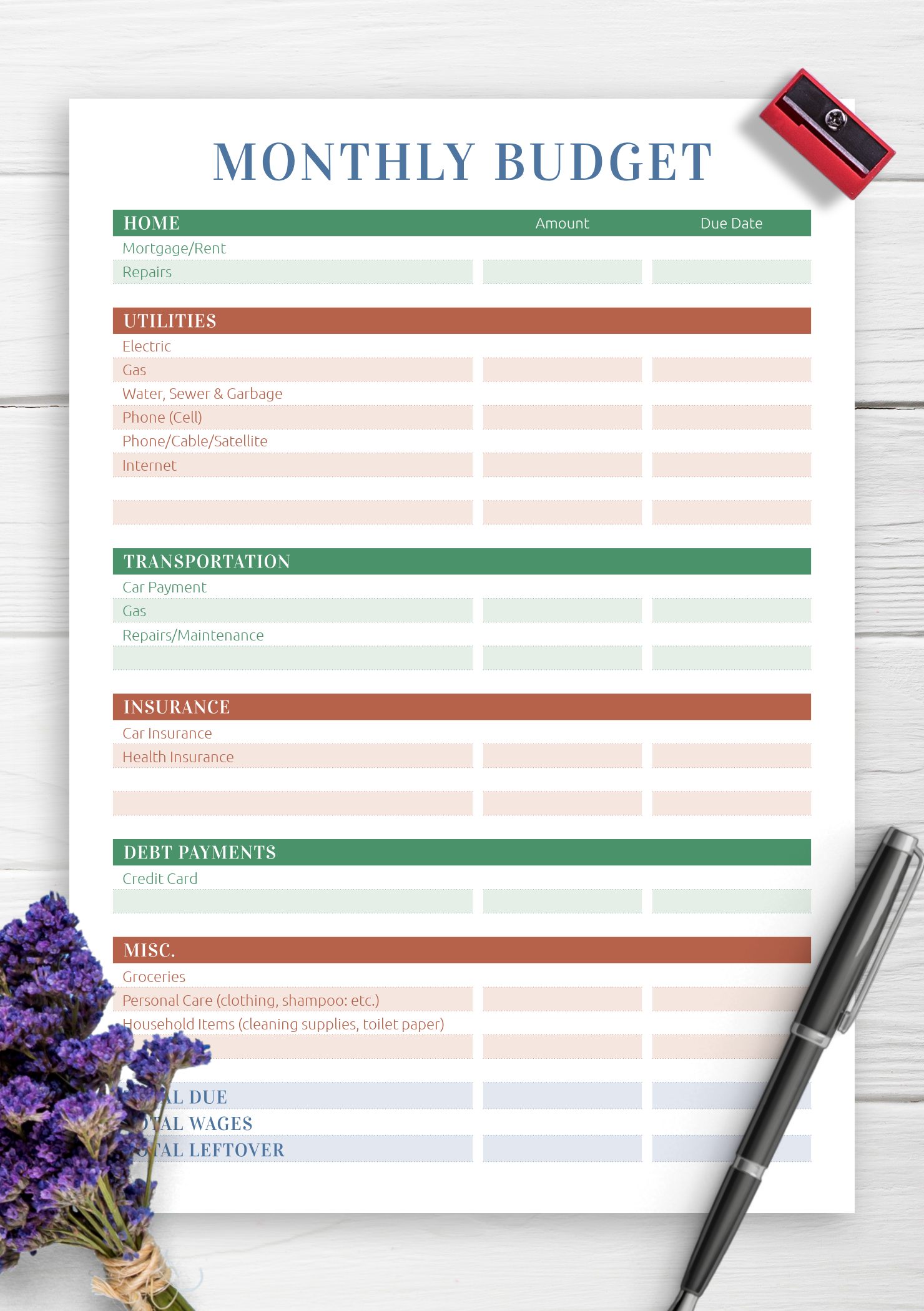

Creating a monthly household budget can be a daunting task, but it's a crucial step in taking control of your finances. With a monthly household budget worksheet pdf, you can easily track your income and expenses, and make informed decisions about how to allocate your money. By having a clear picture of your financial situation, you can identify areas where you can cut back and save money, and make progress towards your long-term financial goals.

Having a budget in place can also help reduce financial stress and anxiety. When you know exactly how much money you have coming in and going out, you can avoid overspending and make smart financial decisions. A monthly household budget worksheet pdf can help you prioritize your spending, and make sure you're allocating enough money for essential expenses like rent, utilities, and groceries.

How to Use a Monthly Household Budget Worksheet Pdf to Save Money

A monthly household budget worksheet pdf is a valuable tool for anyone looking to take control of their finances. It provides a clear and concise way to track your income and expenses, and make adjustments as needed. By using a budget worksheet, you can identify areas where you can cut back and save money, and make progress towards your long-term financial goals. Whether you're looking to pay off debt, build up your savings, or simply get a better handle on your finances, a monthly household budget worksheet pdf can help.

How to Use a Monthly Household Budget Worksheet Pdf to Save Money

Using a monthly household budget worksheet pdf is easy. Simply download the worksheet, and fill in your income and expenses for the month. Be sure to include all of your essential expenses, such as rent, utilities, and groceries, as well as any discretionary spending, like entertainment and hobbies. Once you have a clear picture of your financial situation, you can start making adjustments to save money and achieve your financial goals. By following these simple steps, you can take control of your finances and start building a more secure financial future.