Understanding and Filing the Printable PA Sales Tax Form PA-3R

What is the PA-3R Form?

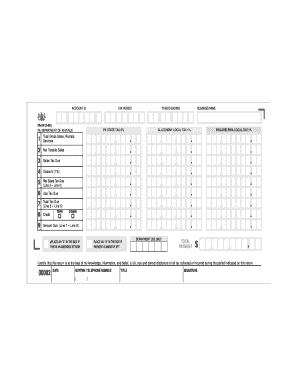

If you're a business owner in Pennsylvania, understanding and correctly filing your sales tax returns is crucial for avoiding penalties and ensuring compliance with state regulations. One of the key forms you'll need to familiarize yourself with is the PA sales tax form PA-3R. This form is used for reporting and paying sales tax to the state, and it's essential to get it right to avoid any issues with the Pennsylvania Department of Revenue.

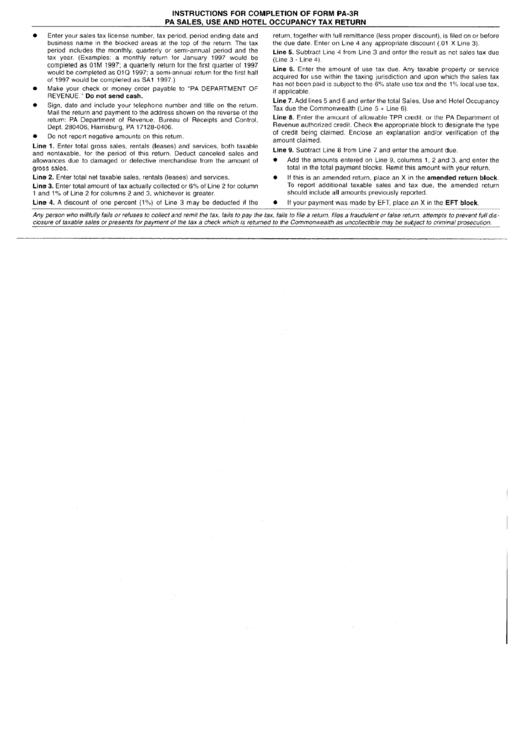

The PA-3R form is designed to be straightforward, allowing businesses to easily report their sales tax liabilities. However, navigating the form and ensuring you're taking advantage of all eligible deductions and exemptions can be complex. It's important to carefully review the form's instructions and seek professional advice if you're unsure about any aspect of the filing process. Fortunately, the form is available in a printable format, making it easier for businesses to complete and submit their sales tax returns accurately.

Filing and Compliance

What is the PA-3R Form? The PA-3R form is specifically used for reporting sales tax on certain types of sales, including retail sales and services that are subject to Pennsylvania sales tax. It's used by a wide range of businesses, from small retailers to large corporations, and is a critical component of the state's sales tax system. By accurately completing and filing the PA-3R form, businesses can ensure they're meeting their sales tax obligations and avoiding potential penalties.

Filing and Compliance To ensure compliance with Pennsylvania sales tax regulations, it's essential to file the PA-3R form on time and accurately. The form can be filed electronically or by mail, and businesses should carefully review the filing deadlines to avoid late penalties. Additionally, keeping accurate records of sales tax payments and filings is crucial in case of an audit or discrepancy. By staying on top of your sales tax obligations and using the printable PA-3R form, you can help ensure your business remains compliant and avoids unnecessary penalties.